Board of Governors of the Federal Reserve System (U.S.), 1935-

and Federal Reserve Board, 1914-1935. "June 1976,"

Federal Reserve Bulletin

(June 1976).

https://fraser.stlouisfed.org/title/62/item/20419 , accessed on March 17, 2025.

June 1976 Date: June 1976

Recent Changes in the Liquidity of Major Sectors of the U.S. Economy

4

Industrial Production - 1976 Revision

11

Revised Indexes of Industrial Production - Total and Market Groupings

20

Federal Reserve Operations in Payment Mechanisms: A Summary

21

Treasury and Federal Reserve Foreign Exchange Operations: Interim Report

30

Independence of the Federal Reserve System

33

Membership of the Board of Governors of the Federal Reserve System, 1913-76

37

Statements to Congress

39

Record of Policy Actions of the Federal Open Market Committee

53

Financial and Business Statistics

97

Member Bank Reserves, Federal Reserve Bank Credit, and Related Items

98

Reserves and Borrowings of Member Banks

100

Basic Reserve Position, and Federal Funds, and Related Transactions

101

Summary of Earlier Changes

102

Reserve Requirements on Deposits of Member Banks

103

Maximum Interest Rates Payable on Time and Saving Deposits

104

Transaction of the System Open Market Account

105

Consolidated Statement of Condition of All Federal Reserve Banks

106

Maturity Distribution of Loans and U.S. Government Securities Held, by Federal Reserve Banks

107

Bank Debits and Deposits Turnover

107

Measures of the Money Stock

108

Components of Money Stock Measures and Related Items

108

Aggregate Reserves and Member Bank Deposits

109

Loans and Investments - All Commercial Banks

109

Principal Assets and Liabilities and Number, by Class of Bank

110

Assets by Class of Bank

112

Liabilities and Capital, by Class of Bank

113

Assets and Liabilities of Large Commercial Banks

114

Commercial and Industrial Loans of Large Commercial Banks

119

Term Commercial and Industrial Loans of Large Commercial Banks

119

Gross Demand Deposits of Individuals, Partnerships, and Corporations

120

Deposits Accumulated for Payment of Personal Loans

120

Loans Sold Outright, by Commercial Banks

121

Commercial Paper and Bankers' Acceptances Outstanding

121

Prime Rate Charged, by Banks

122

Rates on Business Loans of Banks

122

Bond and Stock Yields

124

Stock Market Customer Financing

125

Equity Status of Margin Account Debt at Brokers

126

Special Miscellaneous Account Balances at Brokers, by Equity Status of Accounts

126

Life Insurance Companies

127

Savings and Loan Associations

127

Federal Fiscal Operations: Summary

128

Federal Fiscal Operations: Details

129

Gross Public Debt, by Type of Security

130

Ownership of Public Debt

130

Ownership of Marketable Securities, by Maturity

131

Daily-Average Dealer Transactions

132

Daily-Average Dealer Positions

132

Daily-Average Dealer Financing

132

Major Balance Sheet Items of Selected Federally Sponsored Credit Agencies

133

New Issues of State and Local Government Securities

133

Net Change In Outstanding Corporate Securities

135

Open-End Investment Companies

135

Sales, Revenue, Profits, and Dividends of Large Manufacturing Corporations

136

Corporate Profits, Taxes and Dividends

137

Current Assets and Liabilities of Nonfinancial Corporations

137

Business Expenditures on New Plant and Equipment

137

Mortgage Debt Outstanding by Type of Holder

138

Federal National Mortgage Association and Federal Home Loan Mortgage Corporation - Secondary Mortgage Market Activity

139

Federal National Mortgage Association Auctions of Commitments to Buy Home Mortgages

139

Major Holders of FHA-Insured and VA-Guaranteed Residential Mortgage Debt

140

Commitments of Life Insurance Companies for Income Property Mortgages

140

Terms and Yields on New Home Mortgages

141

Finance Rates on Selected Types of Installment Credit

141

Installment Credit - Total Outstanding and Net Change

142

Installment Credit Extensions and Repayments

143

Selected Business Indexes

146

Construction Contracts and Private Housing Permits

146

Value of New Construction Activity

147

Private Housing Activity

147

Labor Force, Employment, and Unemployment

148

Employment in Nonagricultural Establishments, by Industry Division

148

Wholesale Prices: Summary

149

Gross National Product

150

Relation of Gross National Product, National Income, and Personal Income and Saving

151

Summary of Funds Raised and Advanced in U.S. Credit Markets

152

Direct and Indirect Sources of Funds to Credit Markets

153

U.S. Balance of Payments Summary

154

Merchandise Exports and Imports

155

Gold Reserves of Central Banks and Governments

156

U.S. Liabilities to Foreign Official Institutions, and Liquid Liabilities to All other Foreigners

157

U.S. Liabilities to Official Institutions of Foreign Countries, by Area

158

Short-Term Liabilities to Foreigners Reported, by Banks in the United States, by Type

158

Short-Term Liabilities to Foreigners Reported, by Banks in the United States, by Country

160

Long-Term Liabilities to Foreigners Reported, by Banks in the United States

161

Estimated Foreign Holdings of Marketable U.S. Treasury Bonds and Notes

162

Short-Term Claims on Foreigners Reported, by Banks in the United States, by Type

162

Short-Term Claims on Foreigners Reported, by Banks in the United States, by Country

163

Long-Term Claims on Foreigners Reported, by Banks in the United States

164

Purchases and Sales by Foreigners of Long-Term Securities, by Type

164

Net Purchases or Sales, by Foreigners of U.S. Corporate Stocks, by Country

165

Net Purchases or Sales, by Foreigners of U.S. Corporate Bonds, by Country

165

Net Purchases or Sales, by Foreigners of Long-Term Foreign Securities, by Area

165

Foreign Credit and Debit Balances in Brokerage Accounts

165

Assets of Foreign Branches of U.S. Banks

166

Liabilities of Foreign Branches of U.S. Banks

167

Deposits, U.S. Treas. Securities, and Gold Held at F.R. Banks for Foreign Official Account

168

Short-Term Liquid Claims on Foreigners Reported, by Nonbanking Concerns

168

Short-Term Liabilities to and Claims on Foreigners Reported, by Nonbanking Concerns, by Type

168

Short-Term Liabilities to and Claims On Foreigners Reported, by Nonbanking Concerns

169

Long-Term Liabilities to and Claims on Foreigners Reported, by Nonbanking Concerns

170

Central Bank Rates for Discounts and Advances to Commercial Banks

171

Foreign Exchange Rates

171

Board of Governors of the Federal Reserve System

172

Federal Open Market Committee

174

Federal Advisory Council

174

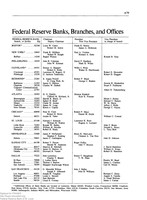

Federal Reserve Banks, Branches and Offices

175

Federal Reserve Board Publications

176

Index to Statistical Tables

181

Federal Reserve System. Boundaries of Federal Reserve Districts and Their Branch Territories

183

Collections within FRASER contain historical language, content, and descriptions that reflect the time period within which they were created and the views of their creators. Certain collections contain objectionable content—for example, discriminatory or biased language used to refer to racial, ethnic, and cultural groups.

@FedFRASER

@FedFRASER