United States. Office of Commissioner of Internal Revenue. "1927,"

Statistics of Income

(1927).

https://fraser.stlouisfed.org/title/61/item/20395 , accessed on April 7, 2025.

1927 Date: 1927

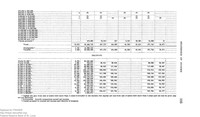

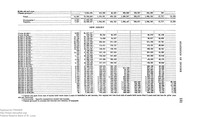

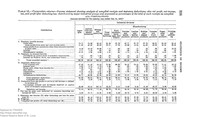

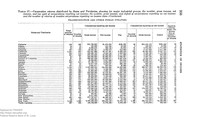

Simple and Cumulative Distribution of Individual Returns, by Income Classes

8

Distribution of Individual Returns, by Sex and Family Relationship

9

Net Income Exempt From and Amount Subject to Normal Tax, Individual Returns

9

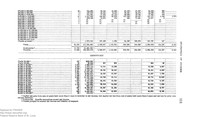

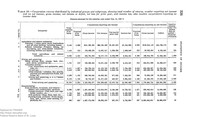

Sources of Income and Deductions in Individual Returns

11

Total Income in Individual Returns Distributed by Net Income Classes, Showing Sources of Income in Detail

12

Percentage Distribution of Total Income in Individual Returns, by Net Income Classes

13

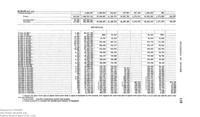

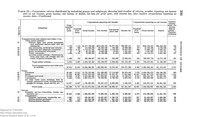

Frequency Distribution by Size of Specific Sources of Income For Individuals Having Net Income over $5,000, Showing for Each Source the Number of Returns and Total Amount

14

Individual Income from Business - Number of Returns and Net Profit by Industrial Groups

15

Returns on Form 1040 and Form 1040B for Estates and Trusts Distributed, by Size of Net Income

16

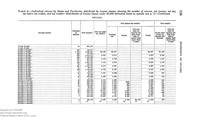

Taxes Paid Other Than Income Tax, Individual Returns

17

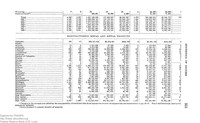

Tax - Exempt Obligations, Showing Amount Owned and Interest Received by Nature of Obligation

18

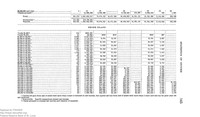

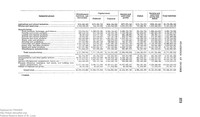

Corporation Returns Distributed by Major Industrial Groups and by Corporations Reporting Net Income and No Net Income

20

Cash and Stock Dividends, Distributed by Years

22

Corporation Returns by Size of Net Income or Deficit for All Corporations

23

Assets and Liabilities, by Corporations Reporting Net Income and No Net Income

24

Corporation Returns - Comparative Statement Showing by the Size of Net Income, the Number of Corporation Income Tax Returns Filed, and the Number of Balance Sheets Tabulated and Tax

25

Corporation Returns Filed for Fiscal Year Showing the Total Number of Returns, Number Reporting Net Income and No Net Income, Net Income or Deficit, Net Loss for Prior Year, and Income Tax, 1926, Distributed by Industrial Groups

26

Returns for Fractional Part of Years

27

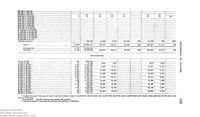

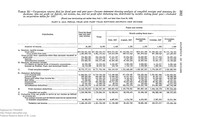

Individual Returns Showing Number of Returns and Net Income

28

Income and Profits Taxes in Individual Returns

28

Number of Individual Returns, by Income Classes

29

Individual Returns, Net Income Reported, by Income Classes

29

Individual Returns, Tax Reported, by Income Classes

31

Individual Returns, Average Tax and Average Rate of Tax, by Income Classes

32

Individual Returns, Total Income, Distributed by Main Sources

33

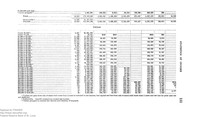

Individuals Required to File Income Tax Returns

37

Surtax Rates Under the Revenue Acts

39

Supplemental Income Taxes and Tax Credits Under the Revenue Acts

42

Corporation Returns Showing Total Number, Number and Percent Reporting Net Income and Reporting No Net Income, and Net Income

44

Income and Profits Taxes in Corporation Returns

44

Corporation Returns Distribution of Number of Returns, Net Income, and Deficit, by Size of Net Income and Deficit for All Corporations

45

Corporation Income and Profit Tax Rates Exemptions, and Credits Under Revenue Acts

47

Income and Profits Taxes Paid in Foreign Countries

50

Estates of Resident Decedents by Size of Net Estate

52

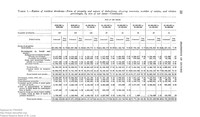

Estates of Resident Decedents - Distribution by States and Territories and by Estates Subject to Tax and Estates Not Subject to Tax

58

Estates of Resident Decedents - Date of Death After February 26, 1926, Taxed Under the Revenue Act of 1926 - Distribution by States and Territories and by Estates Subject to Tax and Estates Not Subject to Tax

60

Estates of Resident Decedents - Date of Death After June 2, 1924, and Prior to February 26, 1926, Taxed Under the Revenue Act of 1924 - Distribution by States and Territories and by Estates Subject to Tax and Estates Not Subject to Tax

62

Estates of Resident Decedents - Date of Death Before June 2, 1924, Taxed Under the Revenue Acts in Force Prior to the Revenue Act of 1924 - Distribution by States and Territories and by Estates Subject to Tax and Estates Not Subject to Tax

64

Estates of Resident Decedents - Distribution by Size of Net Estate

66

Estates of Nonresident Decedents, Distribution by Size of Net Estate

66

Historical Comparison, by Resident and Nonresident Decedents, of Number of Returns, Gross and Net Estate, and Tax

67

Change in Tax Laws Affecting the Comparability of Statistical Data from Estate Tax Returns

67

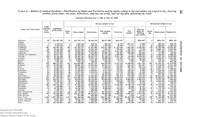

Individual Returns - Distribution by States and Territories

70

Individual Returns - Distribution by Income Classes

72

Individual Returns - Distribution by Simple and Cumulative Distribution of the Number of Returns

74

Individual Returns - Distribution of Number of Returns and Net Income by States and Territories and According to Sex and Family Relationship

77

Individual Returns Distribution of Number of Returns and Net Income by Income Classes and According to Sex and Family Relationship

80

Individual Returns Distribution of Income by Sources and by States and Territories

83

Individual Returns Distribution of Income by Sources and by Income Classes

86

Individual Returns - Tax-Exempt Obligations Reported in Returns of Net Income Over $5000

89

Corporation Returns by States and Territories, Distributed by Corporations Reporting Net Income, No Net Income, and Inactive Corporations

314

Corporation Returns by States and Territories, Showing Cash and Stock Dividends Paid to Shareholders

315

Corporations Reporting Net Income

320

Corporations Not Reporting Net Income

324

Corporation Returns Distributed by Industrial Groups and Subgroups

330

Agriculture and Related Industries

336

Food Products, Beverages, and Tobacco

341

Textiles and Textile Products

342

Leather and Leather Products

344

Rubber and Rubber Goods

345

Lumber and Wood Products

347

Paper, Pulp, and Products

348

Printing and Publishing

350

Chemicals and Allied Products

352

Stone, Clay, and Glass Products

353

Metal and Metal Products

355

Manufacturing Not Elsewhere Classified

357

Transportation and Other Public Utilities

360

Service - Professional, Amusements, Hotels, Etc.

363

Finance - Banking, Insurance, Real Estate and Holding Companies Stockbrokers

364

Nominal Concerns - Nature of Business Not Given

366

Combinations - Predominant Industry Not Define

368

Corporate Returns - Distribution of Number of Returns and Net Income by Size of Net Income and by Major Industrial Groups

369

Corporations Reporting Net Income

378

Corporations Reporting No Net Income

381

Corporation Returns - Comparative Statement Showing by the Size of Net Income, the Number of Corporation Income Tax Returns Filed, and the Number of Balance Sheets Tabulated by Major Industrial Divisions

384

Corporation Returns Filed for Fiscal Year Showing the Total Number of Returns, Number Reporting Net Income and No Net Income, Net Income or Deficit, Net Loss for Prior Year, and Income Tax, 1927, Distributed by Industrial Groups

388

Corporation Returns Filed All Fiscal Year and Part Year Returns

393

Corporation Returns Filed All Fiscal Year and Part Year Returns Showing Net Income

396

Corporation Returns Filed All Fiscal Year and Part Year Returns Showing No Net Income

400

Collections within FRASER contain historical language, content, and descriptions that reflect the time period within which they were created and the views of their creators. Certain collections contain objectionable content—for example, discriminatory or biased language used to refer to racial, ethnic, and cultural groups.

@FedFRASER

@FedFRASER