United States. Office of Commissioner of Internal Revenue. "1922,"

Statistics of Income

(1922).

https://fraser.stlouisfed.org/title/61/item/20390 , accessed on April 30, 2025.

1922 Date: 1922

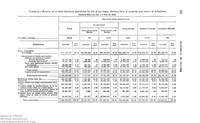

Personal Returns, by States and Territories, and Per Capita Distribution

8

Simple and Cumulative Distribution of Personal Returns, by Income Classes

10

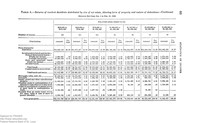

Distribution of Personal Returns, by Sex and Family Relationship

11

Net Income Exempt From and Amount Subject to Normal Tax, Personal Returns

12

Distribution by Sources, Personal Income

12

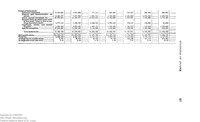

Distribution by Sources of Income and Deductions, by Income Classes

13

Distribution of Personal Income, by Sources and Income Classes

14

Distribution of Personal Income, by Sources and by Income Classes, Showing the Proportion From Each Source Expressed in Percentages

15

Income Reported From Business Pursuits, Personal Returns

15

Individuals (165) Reporting Net Income of $300,000 and Over for Selected Year, Who Would Have Reported Less Than $300,000 Without Capital Net Gain, Showing the Net Income and the Amount of Income From Sale of Capital Assets Held For More Than Two Years

16

Individuals Reporting Net Income of $300,000 and Over for Selected Years

17

Distribution by Sources of Income - Returns of 436 Individuals Each of Whom Reported Net Income of $300,000 and Over for the Selected Year

18

Income Class Distribution of 537 Individuals Reporting Net Income of $300,000 and Over for a Selected Year

19

Income Class Distribution of the Four Groups Into Which the 537 Returns Reporting Net Income in Excess of $300,000 for a Selected Year are Segregated

19

Distribution of Corporations by Industrial Groups and Into Those Reporting Net Income and Those Reporting No Net Income

21

Dividends Paid Stockholders on the Capital Stock of Corporations

23

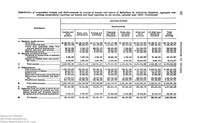

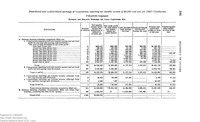

Distribution of Corporation Receipts and Disbursements by Sources of Income and Nature of Deductions by Industrial Divisions; Aggregate Comprising Corporations Reporting Net Income and Those Reporting No Net Income

24

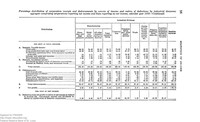

Percentage Distribution of Corporation Receipts and Disbursements, by Sources of Income and Nature of Deductions, by Industrial Divisions; Aggregate Comprising Corporations Reporting Net Income and Those Reporting No Net Income

29

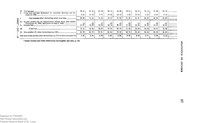

Corporation Returns Distributed by Size of Net Income

33

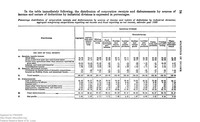

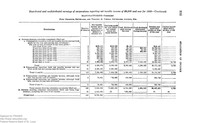

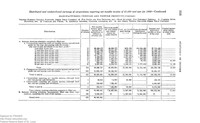

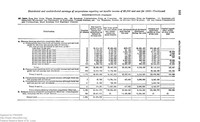

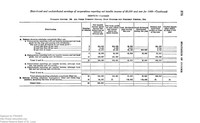

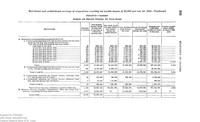

Distributed and Undistributed Earnings of Corporations Reporting Net Taxable Income of $2,000 and Over for a Selected Year

34

Personal and Corporation Income and Tax, by States and Territories

35

Income From Sources Within the United States and Its Possessions

36

Income From Sources in Foreign Countries

36

Number of Personal Returns, by Income Classes

37

Returns of Net Income, by Years - Personal and Corporation

37

Income Tax Yield by Years - Personal, Partnership and Corporation

38

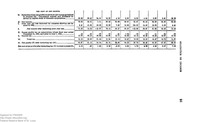

Personal Returns - Net Income Reported, by Income Classes

39

Personal Returns - Tax Yield for Calendar Years, by Income Classes

39

Personal Returns - Average Tax and Average Rate of Tax Per Individual, by Income Classes

40

Personal Returns - Income, by Sources

41

Capital Stock Tax Returns - Distribution by Industrial Groups - Aggregate, Taxable and Nontaxable

45

Capital Stock Tax Returns - Distribution by Industrial Groups - Taxable

49

Capital Stock Tax Returns - Distribution by Industrial Groups - Nontaxable

53

Capital Stock Tax Returns - Distribution by Size of Capital Stock Fair Value

57

Capital Stock Tax Returns - Distribution by States and Territories

58

Returns of Resident Decedents Distributed, by Size of Net Estate, Showing Form of Property and Nature of Deductions

62

Returns of Resident Decedents Distributed, by Size of Net Estate

68

Returns of Nonresident Decedents Distributed, by Size of Net Estate

68

Simple and Cumulative Distribution, by Size of Net Estate - Aggregate Resident and Nonresident Decedents

69

Vocational Distribution by Sex and Size of Net Estate of the Returns of Resident Decedents

70

Returns of Resident Decedents Distributed, by Size of Net Estate, Age and Sex, and Single or Married

74

Returns of Resident Decedents Distributed, by States and Territories

77

Personal Returns - Distribution of Income, by States, for the United States, Showing for Each State the Number of Returns, Net Income, Tax and Relative Percentages

80

Personal Returns - Distribution by Income Classes, for the United States, Showing for Each Class of Income the Number of Returns, Net Income, Personal Exemption, Dividends, Tax Paid and Percentages

83

Personal Returns - Simple and Cumulative Distribution by Income Classes

85

Personal Returns - Sex and Family Relationship - Distribution by States, for the United States

88

Personal Returns - Sex and Family Relationship - Distribution by Income Classes, for the United States

90

Personal Returns - Distribution of Income, by Sources and by States, for the United States

93

Personal Returns - Distribution of Income, by Sources and by Income Classes, for the United States

96

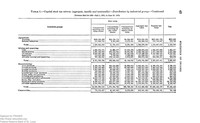

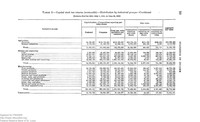

Corporation Returns Distribution by States for the United States

99

Agriculture and Related Industries

100

Transportation and Other Public Utilities

105

Agriculture and Related Industries

139

Food Products, Liquors, and Tobacco

140

Textile and Textile Products

140

Leather and Leather Products

140

Rubber and Rubber Products

141

Lumber and Wood Products

141

Paper, Pulp, and Products

141

Printing and Publishing

142

Chemicals and Allied Substances

142

Stone, Clay, and Glass Products

142

Metal and Metal Products

143

All Other Manufacturing Industries

143

Transportation and Other Public Utilities

144

Public Service - Professional, Amusements, Hotels, Etc.

144

Finance - Banking, Insurance, and Related Business

145

Combinations - Predominant Industry Not Ascertainable

145

Washington Including Alaska

260

Summary of Agriculture and Related Industries

273

Fruit and Stock Farming

294

Related Agricultural Industries

296

Summary of Mining and Quarrying

274

Summary of All Manufactures

275

Summary of Food Products, Beverages, and Tobacco

276

Bread and Bakery Products

303

Milling, Flour, Meal and Feed

304

Cereal, Fish Canning, Poultry, Sugar, and All Other Food Products

305

Dairy Products and Butter Substitutes

306

Chocolate, Confectionery, and Ice Cream

307

Fruit and Vegetable Canning

309

Cereal Beverages and Alcohol

313

Summary of Textiles and Textile Products

277

Woolen and Worsted Goods

316

Felt Goods, Linen and Flax, All Other Textile Fabrics

318

Fur Goods, Carpets, Cordage and Twine, Artificial Leather, and All Other Textile Products Other Than Clothing

319

Custom-Made Clothing, Men's Clothing, and All Other Clothing

320

Hats and Caps, Corsets, and Shirts

322

Hosiery and Knit Goods

323

Summary of Leather and Leather Products

278

Saddlery and Harness, Trunks and Valises, Tanning and Finishing Leather, and All Other Leather Products

326

Summary of Rubber and Rubber Goods; also Celluloid, Ivory, Shell, and Bone

279

Boots and Shoes; Belting, Hose, and Tires; Celluloid, Ivory, Shell, and Bone; and All Other Rubber Goods

327

Summary of Lumber and Wood Products

280

Saw and Planing Mill Products

328

Furniture, All Classes

329

Carriage and Wagon Parts and All Other Lumber and Wood Products

330

Summary of Paper, Pulp, and Products

281

All Paper, Pulp, and Paper Products

331

Summary of Printing and Publishing

282

General Printing and Publishing

332

Combinations of Paper Manufacturing and Printing, When Unable to Ascertain True Nature of Business

333

Special Processes and Tributary Industries

334

Summary of Chemicals and Allied Products

283

Chemicals Proper, Acids, and Other Compounds

335

Oils, Vegetable and Animal

337

Petroleum and Mineral Refining and Products

338

Soaps, Fertilizers, All Other Chemicals and Allied Substances

339

Summary of Stone, Clay and Glass Products

284

Cut Building Stone and Crushed Stone

340

Brick, Tile, Terra Cotta, and Fire Brick

341

Glass and Glass Products

342

Summary of Metal Manufactures and All Other Manufacturing Concerns Not Identified as Specifically Belonging to Any Other Main Industrial Division

285

Metal Products or Iron and Steel, or Iron and Steel and Other Metals

343

Metal Products, Not Iron and Steel

351

Summary of Construction

286

Excavation and Construction Under or Upon the Ground (Not Buildings)

354

Jetty, Dam, Dry Dock, Wharf; Railroad Construction, Ship Building, Equipping, and Installing Machinery, Wreckingm and All Other Construction

355

Building and Structures Above Ground

356

Summary of Transportation and Other Public Utilities

287

Railroad Transportation

357

Local Transportation, Cartage, and Storage

361

Professional and Other Services

383

Banking and Related Business

389

Insurance Companies, Not Agents

397

All Other Finance, Main Business Not Precisely Defined

399

Summary of Concerns Not Identified as Specifically Belonging to Any Other Main Industrial Division

291

All Other Active Concerns Whose Business Can Not be Identified with Main Division; Also Combinations of Main Divisions When the Main Business is Not Given

400

Collections within FRASER contain historical language, content, and descriptions that reflect the time period within which they were created and the views of their creators. Certain collections contain objectionable content—for example, discriminatory or biased language used to refer to racial, ethnic, and cultural groups.

@FedFRASER

@FedFRASER